25+ what is assumed mortgage

Web An assumable mortgage is a loan that can be transferred from one party to another with the initial terms remaining in place. Estimate Your Monthly Payment Today.

Jonathan Driver Mba Sales Manager Zeuslending Com Linkedin

But the homeowner would still need to be compensated for the 100000 of equity.

. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

All Major Categories Covered. Web Homebuyers can be interested in assuming a mortgage when the rate on the existing loan is significantly lower than current rates. Web Based on data compiled by Credible mortgage refinance rates have risen for one key term and remained unchanged for three other terms since yesterday.

Web An assumable mortgage is a loan that can be transferred from the original borrower to a new borrower with the same mortgage rate mortgage payment and other terms and. If the home is worth more than when the original loan was issued the buyer must cover the difference with. Web An assumable mortgage is a type of mortgage program that allows you to transfer your mortgage loan to the new buyer of your house.

Web An assumable mortgage doesnt account for equity. For buyers and sellers in a rising interest. Ad More Veterans Than Ever are Buying with 0 Down.

In a divorce situation the. Web An assumable mortgage is a type of financing arrangement in which the current owners outstanding mortgage and its terms are transferred to the buyer. Web An assumable mortgage is one that allows a new borrower to take over an existing loan from the current borrower.

Web An assumable mortgage is an arrangement in which an outstanding mortgage and its terms can be transferred from the current owner to a buyer. Web To apply for an assumption you have to be able to show the lender that you have been given the legal rights to handle the property. Find Out If You Qualify Now.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. In order words you are selling your. Web An assumable mortgage is a mortgage loan that another borrower can take over while keeping the original terms and conditions which is sometimes better than.

For example if the seller has a 225 interest. It is a loan and you must be 62. Typically this entails a home buyer taking over.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Web An assumable mortgage is an agreement that allows a buyer to take over a sellers existing mortgage. Web If you assumed the mortgage you would be taking over a loan with a balance of 300000.

Web An assumable mortgage is simply put one that the lender will allow another borrower to take over or assume without changing any of the terms of the mortgage. Web An assumable mortgage is a type of financing arrangement where the current property owner is able to transfer the mortgage to the new buyer. Select Popular Legal Forms Packages of Any Category.

For more than 25 years she has written and reported on.

How To Assume A Mortgage 10 Steps With Pictures Wikihow

The Business Exchange By The Business Exchange Corp Issuu

Oatka Edition Genesee Valley Penny Saver 9 25 2020 By Genesee Valley Publications Issuu

Share Of Young People In The Eu Aged 25 34 Who Are Still Living With Their Parents Oc 1200x1200 R Mapporn

Home Loan Experts Questions Productreview Com Au

Inventory Valuation Methods Types Advantages And Disadvantages

Resources London Mortgage Partners

The Mesa Tribune 010823 Zone 1 By Times Media Group Issuu

Loan Syndication How Does Loan Syndication Work With Example

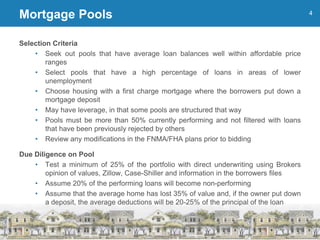

Investordaypresentation2

How To Assume A Mortgage 10 Steps With Pictures Wikihow

How To Assume A Mortgage 10 Steps With Pictures Wikihow

Mortgage Choice Page 5 Productreview Com Au

Cdlaf Presentation April Rework

How To Assume A Mortgage 10 Steps With Pictures Wikihow

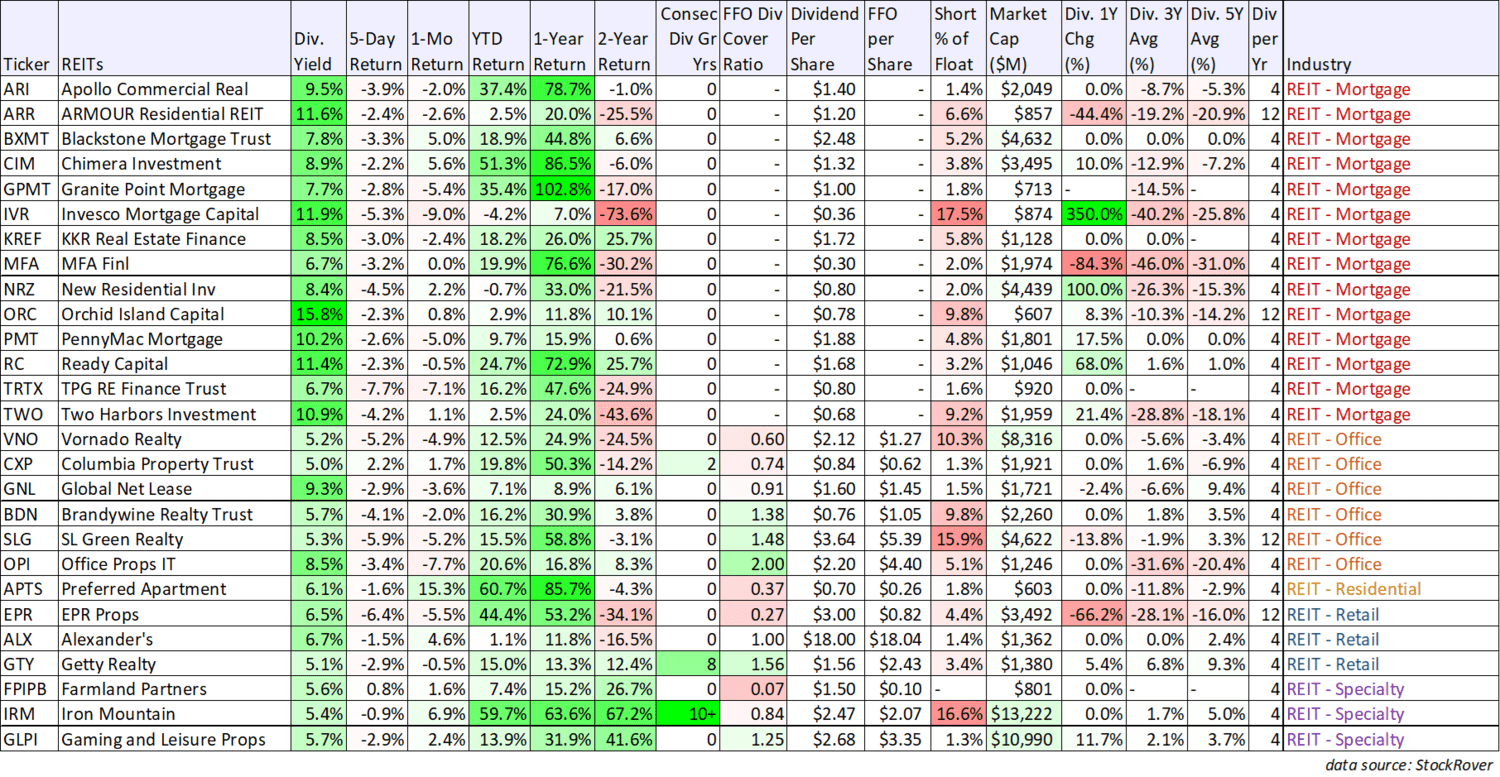

75 Big Dividend Reits Bdcs Cefs These 3 Are Worth Considering Seeking Alpha

Is An Assumable Mortgage Right For You Quicken Loans